Lately, the allure of precious metals, particularly gold and silver, has captured the attention of traders, collectors, and on a regular basis consumers alike. As financial uncertainties loom and inflation considerations rise, many are turning to those timeless belongings as a hedge against monetary instability. This article explores the advantages of purchasing gold and silver, the varied methods to spend money on them, and key concerns for potential consumers.

The Historical Significance of Gold and Silver

Gold and silver have been cherished for centuries, serving not only as foreign money but additionally as symbols of wealth and status. Civilizations throughout historical past have utilized these metals for commerce, jewelry, and even as a form of art. At this time, their intrinsic value continues to make them extremely wanted, significantly in times of economic volatility. Unlike paper forex, which could be printed at will, gold and silver are finite sources, giving them a unique place in the monetary market.

Why Put money into Precious Metals?

- Hedge Towards Inflation: One in all the first reasons traders flock to gold and silver is their capability to retain value during inflationary periods. As the price of dwelling rises, the purchasing power of currency typically diminishes. Valuable metals, on the other hand, tend to extend in worth, offering a safeguard for traders.

- Portfolio Diversification: Together with gold and silver in an investment portfolio can enhance diversification. Precious metals typically have a low correlation with conventional stocks and bonds, that means they might help stabilize a portfolio throughout market fluctuations.

- Protected Haven Asset: During occasions of geopolitical uncertainty or economic downturns, gold and silver are seen as secure-haven assets. Traders often turn to those metals when confidence in monetary markets wanes, leading to elevated demand and higher costs.

- Tangible Assets: In contrast to stocks or bonds, best gold purchase online and silver are physical belongings that can be held and saved. This tangibility can provide peace of mind for buyers who want to have a tangible illustration of their wealth.

Strategies of Purchasing Gold and Silver

For these all for investing in gold and silver, there are a number of strategies to consider:

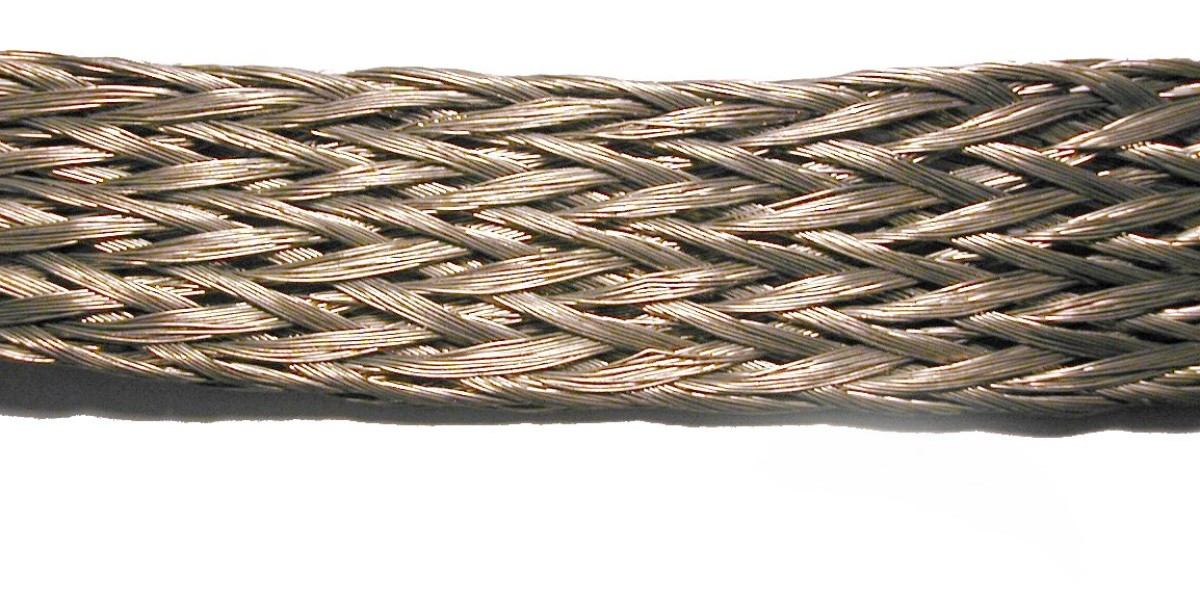

- Bodily Bullion: The most simple option to put money into precious metals is by purchasing physical bullion within the form of coins or bars. Widespread coins include the American Gold Eagle, Canadian Maple Leaf, and South African Krugerrand. When shopping for physical bullion, it is important to contemplate elements like purity, weight, and respected dealers to make sure a secure purchase.

- Change-Traded Funds (ETFs): For many who choose a extra fingers-off approach, gold and silver ETFs provide a chance to put money into precious metals with out the need to store bodily assets. These funds monitor the worth of gold or silver and may be traded like stocks on major exchanges.

- Mining Stocks: Investing in mining corporations could be another means to achieve exposure to gold and silver. These stocks can provide leveraged returns when treasured metallic prices rise, but they also come with additional risks related to operational efficiency and market dynamics.

- Futures and Options: More skilled buyers may explore futures and options contracts that allow them to speculate on the long run worth movements of gold and silver. Whereas these instruments can present vital profit potential, in addition they carry increased risks and require a solid understanding of market mechanics.

- Jewellery and Collectibles: Purchasing gold and silver in the form of jewelry or collectibles will also be an choice. However, it is essential to recognize that the value of these things could not solely be primarily based on the metal content but in addition on craftsmanship, rarity, and market demand.

Considerations Before Buying

Earlier than diving into the world of gold and silver investment, potential buyers should consider the following elements:

- Market Analysis: Understanding the current market trends is crucial. Prices of gold and silver can fluctuate based on numerous components, together with financial indicators, curiosity rates, and geopolitical events. If you loved this article and you would certainly like to receive more information pertaining to https://bycsoft.com/author/loren49469/ kindly browse through our web site. Staying informed can help buyers make well timed decisions.

- Storage and Security: If choosing bodily bullion, buyers should consider how they'll retailer their investments securely. Options include house safes, bank safety deposit bins, or third-party storage amenities. Every option comes with its personal set of costs and dangers.

- Premiums and Fees: When purchasing physical gold and silver, patrons should remember of premiums and charges that could be added to the spot price. These can embrace supplier markups, shipping prices, and taxes. Understanding the overall price of acquisition is vital for evaluating investment returns.

- Long-Term Perspective: Investing in precious metals ought to typically be considered as a protracted-time period strategy. While prices can be volatile in the brief term, historical traits show that gold and silver have consistently appreciated over prolonged periods.

- Consulting Professionals: For these new to investing in precious metals, seeking advice from financial advisors or professionals in the field can provide helpful insights and guidance tailor-made to individual monetary targets.

Conclusion

As the global economy continues to face uncertainties, the appeal of purchasing gold and silver stays strong. These valuable metals not only serve as a hedge against inflation and economic instability but also offer a tangible asset that may diversify investment portfolios. Whether or not by way of bodily bullion, ETFs, or mining stocks, there are numerous avenues for traders to explore. Nonetheless, it is important to conduct thorough research, consider market dynamics, and method investments with an extended-term perspective. By understanding the intricacies of gold and silver investment, individuals could make informed choices that align with their monetary objectives and risk tolerance. Because the adage goes, "All that glitters just isn't gold," however in the case of treasured metals, the shimmer of opportunity is undeniable.